In developing strategic business plans, we often use Best, Expected, and Worst case scenarios. Life and business are risky. Planning for the down turns is prudent and necessary. A business plan based on prolonged luck is not a recipe for success. The durable, businesses that have stood the test of time, have usually survived as the result of strategic and tactical planning for the short and prolonged down turns. Every business will experience trials and most bad things can be planned and managed. As an extreme example, bad things like death can either ruin your plan, or it can just be a part of your business continuity plan.

However, while it is prudent and necessary to plan for potential bad things, there can be a tendency to over-emphasize the bad possibilities when evaluating a new opportunity such as a business acquisition. While re run Best, Expected, and Worst case scenarios, most eyes gravitate to the Worst section, and we quickly dismiss the Best section as having rose colored glasses, “That will never happen.”

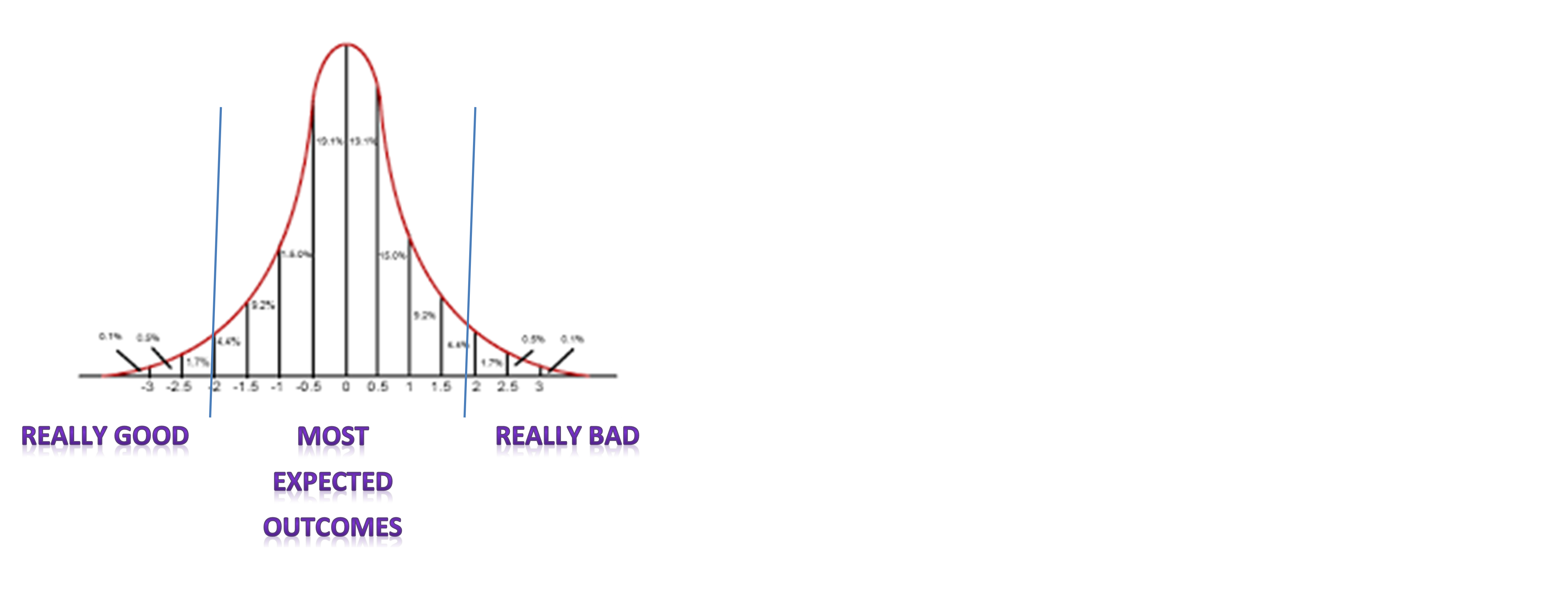

While thinking about purchasing your first entrepreneurial adventure or your next strategic expansion acquisition, we all need to weigh the cost and examine our security effects of the bad things. Buyers and their lenders tend to emphasize the worst case end of the spectrum because security is a deep survival instinct in us. Life and business is largely unpredictable. When we try to list possible events and outcomes, we’ll probably get a bell shaped curve ranging from “really, really good” outcomes through “expected” outcomes to “really, really bad” outcomes.

If you find yourself over-concentrating on the bad, try this: Think of the cost magnitude of years of lost profits because we overemphasized the bad and didn’t take the leap. Sorry kids, we don’t have enough saved for your college education because we didn’t take the chance when we were younger. Now there’s an equally disturbing picture of a really bad outcome. If we focus on and plan for the most likely scenarios, we’ll have the best chance of managing those likely scenarios well and will make the most of the expected outcomes. So think about the bad things and how they can be mitigated, but don’t live there. Concentrate on the expected things because that is probably what will happen.

If we focus all our attention on the really bad, we’ll probably not take any risk because of the 0.5% chance of the worst case scenario. Few, if any worst case scenarios show positive cash flow. If we are always worried about what could go wrong, chances are we won’t start a potentially profitable business.

Expect the expected. Things are usually what they seem. That’s the way to bet if you’re playing the odds.