Why You Should Buy That Business Now

Why You Should Buy That Business Now

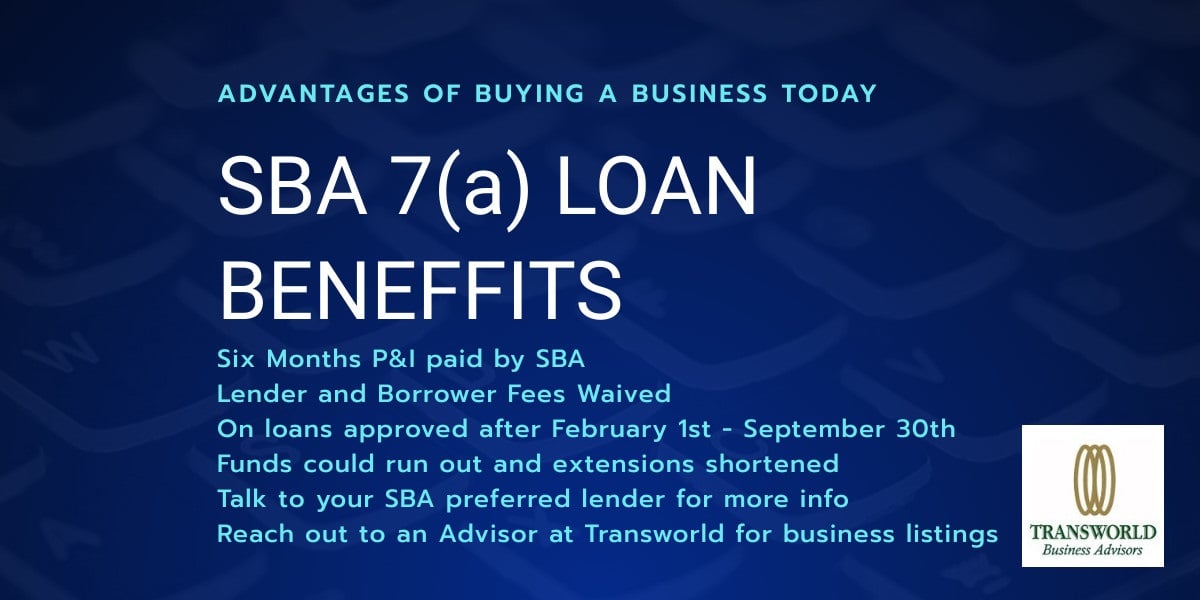

There are renewed benefits to using an SBA 7A Business loan to purchase a business. But you may have to act quickly to take advantage of it, because they money is expected to run out before the September deadline. The Economic Aid to Hard-Hit Small Businesses, Nonprofits and Venues Act (The Economic Aid Act) was signed in to law on December 27th, 2020. Included in this legislation:

1. SBA will pay the P&I (principal and interest) on the first 6 months of newly approved loans, approved between February 1 and September 30, 2021. The payments are capped at $9,000 per month.

2. The SBA will be waiving lender and borrower fees for both the 7(a) and 504 loan programs. This amount is up to 2.5% of the amount borrowed, so the benefit can be significant.

3. The SBA is temporarily increasing loan repayment terms from six to eight years.

4. Enhances the loan program making it easier for lenders to lend money to small business owners by increasing the guarantee amount, extending the repayment term, maximizing flexibility and reducing red tape for lenders.

Things To Know

1. The SBA could reduce the extensions provided if the funds run out

2. The SBA may establish a minimum loan maturity period for each loan product covered under this law to prevent program abuse.

3. Applicants may only receive relief for one loan.

Contact an approved SBA lender to learn more about this program. You can read more about this law from our COVID-19 resource page under Loan Resources.