Research Before Buying

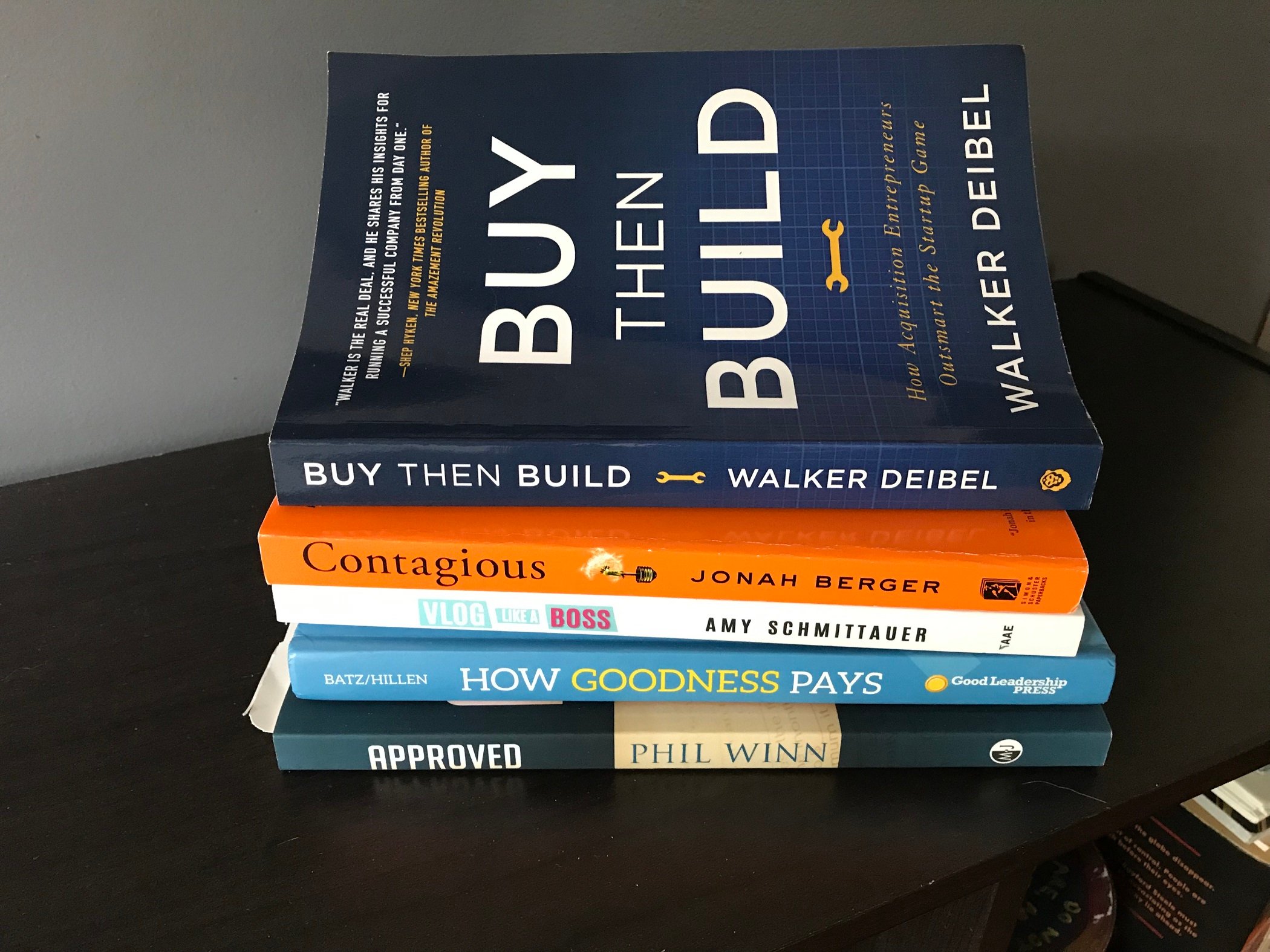

If you are considering purchasing a business, Walker Deibel's book "Buy Then Build: How Acquisition Entrepreneurs Outsmart the Startup Game" is a helpful book to read before getting started. Deibel walks through the benefit of buying an existing business rather than starting one and discusses the benefits of ownership.

Don't Start A Business

"Acquire a successful business then use cash flow to innovate and upgrade". According to Deibel, an acquisition is more affordable than you might think.

Engineer Wealth

"The concept of return on investment (ROI) is simple..." Deibel lays out what makes a good investment and the margin of risk.

How To Start Your Search

"Most people start looking for a company to acquire completely the wrong way." This book teaches you how to create parameters for looking for a business to buy, and doesn't cut corners on detail, in three substantial chapters.

Bringing The Deal Together

"Acquiring a company isn't a linear process, and there are some actions you'll need to take now in order to succeed later." Understanding leverage, what banks are looking for, different debt options, working with CPAs and attorneys and reviewing business listings are all things you will need to know before buying a business.

Understanding The Numbers

"Rule number one for establishing a purchase price is making sure the business can afford to pay for the business. You will learn the different types of accounting, how to determine how healthy the business is, understanding balance sheets, valuation and what "goodwill" is.

The seller Is Key

"Most inexperienced buyers will go in to their first meeting with a seller without trusting them." Understanding the seller's perspective and winning them over can result in the best deal for the buyer.

Creating The Business Plan

Building and executing your plan is the first step in growing an existing business. Deibel helps lay the framework for this process.

Offer, Acquisition and Transition

Writing a letter of intent, the difference between an asset and a stock sale, deal structure, and contingencies all need to be considered. Emotions can run high, and communication is critical to a successful deal close and transition.

Working With A Broker

Transaction brokers help by searching for businesses that meet the buyers goals, act as intermediaries between the buyer and the seller, and keep the deal moving forward to close. Brokers will typically work with buyers on a retainer which can be deducted from the broker fee at close, most often times paid by the seller. Contact us today to get started on your journey to becoming the CEO of your own business.